How Personal Loans Canada can Save You Time, Stress, and Money.

Wiki Article

Not known Details About Personal Loans Canada

Table of ContentsThe Facts About Personal Loans Canada UncoveredThe Basic Principles Of Personal Loans Canada Top Guidelines Of Personal Loans CanadaThe Ultimate Guide To Personal Loans CanadaTop Guidelines Of Personal Loans CanadaThe Buzz on Personal Loans Canada

The rate of interest a loan provider supplies you might vary depending upon: your credit rating the type of lender the sort of car loan (safeguarded or unsecured) You do not need to take lending insurance coverage with an individual funding. Your loan provider may use optional creditor loan insurance for your individual loan. With a personal financing, you concur to make routine payments.Some lenders will send out information concerning your personal loan payments to the credit report bureaus. Lenders may allow you to make additional payments to pay off your financing faster.

This might help you manage your spending plan if your monetary scenario changes. There may be a cost for this solution. Before you secure a personal financing, you ought to consider your circumstance and your ability to pay it back. If you're having problem making your settlements, contact your lending institution. If you think your checking account balance will not cover your loan settlement, you may consider over-limit protection.

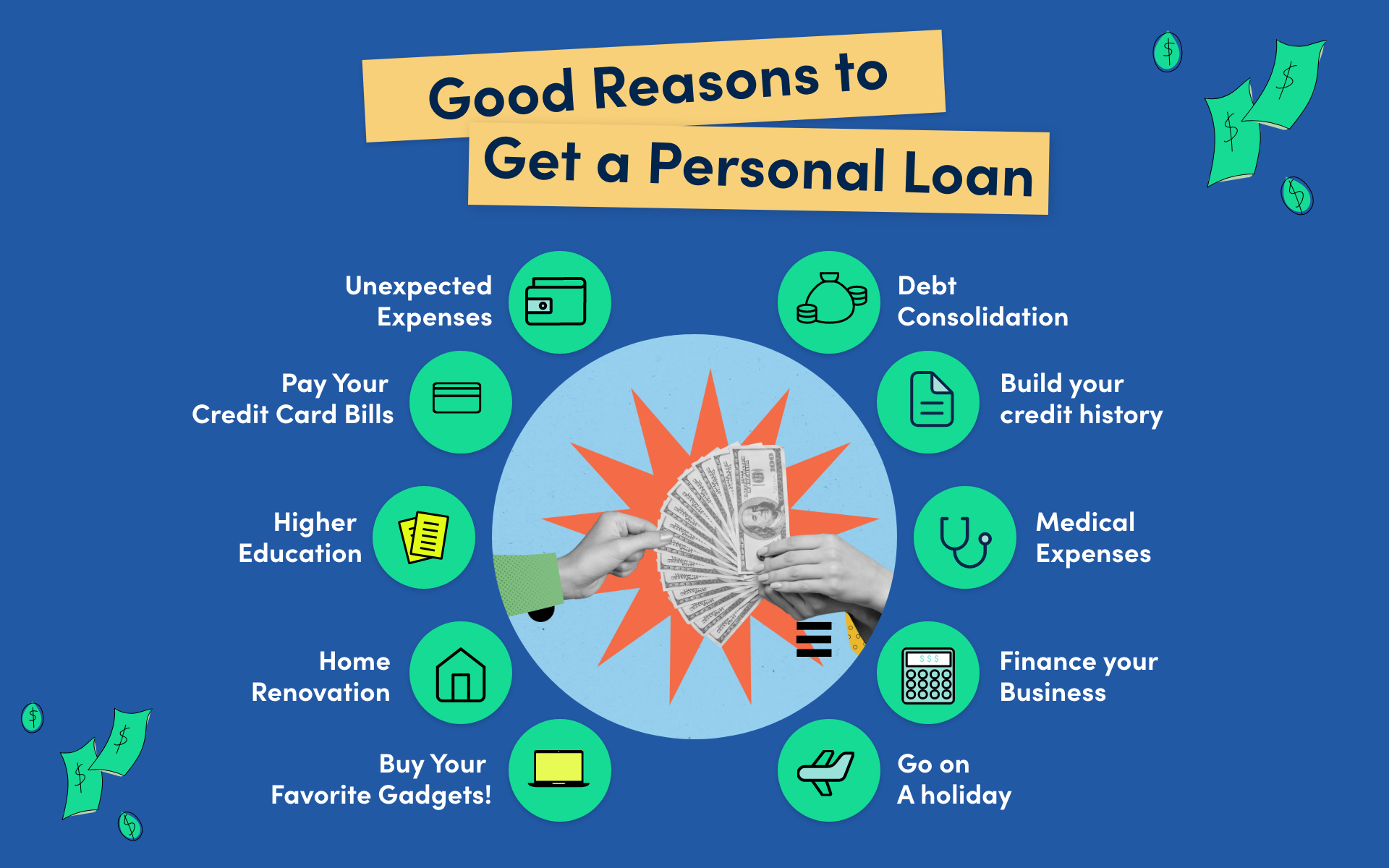

Need some additional funds to make a huge acquisition, repay financial obligation, or cover the expense of a significant expense like a dream trip or wedding? Many individuals turn to personal loans in such situations. A personal funding is money provided to you with rate of interest. You have to pay the funding amount back plus interest within a duration you and the loan provider concur on.

Indicators on Personal Loans Canada You Should Know

Lenders consider aspects such as your debt report, credit rating, and debt-to-income proportion to determine just how dangerous it is to offer you money. The passion you pay is called an annual portion rate (APR). The APR is usually carefully tied to your credit history. The better your credit scores, the far better rates and terms available to you.

If you're authorized for a personal loan, you'll get a round figure of money, but you'll need to pay it back in month-to-month installations until the finance term runs out. This is a crucial initial question to ask yourself, so take a while to think of it. Remember, you'll owe rate of interest throughout of the loan, so you're always paying greater than the first quantity you're obtaining.

The 20-Second Trick For Personal Loans Canada

Ensure you need the financing which you have the ability to pay it back. On the other hand, if getting a personal funding to combine substantial financial debt can aid you settle that financial obligation quicker, it could be a good choice. Doing so can possibly conserve you cash by lowering your rate of interest, along with make it a lot more workable by lowering your overall month-to-month settlement quantity.That's because, specifically if you have great credit scores, personal financings commonly have much better passion prices than bank card. If you're considering a funding to cover clinical expenses, get in touch with the health center first to see if their payment department will function with you on a layaway plan. At the end of the day, if you do not need to get a personal finance, after that do not.

There could be restrictions based upon your credit rating or history. Make sure the loan provider uses fundings for at least as much cash as you need, and look to see if there's a minimal finance amount. Nonetheless, recognize that you might not get accepted for as huge of a lending as you desire.

Variable-rate finances tend to start with a lower rate of interest, however the price (and your payments) could rise in the future. If you desire certainty, a fixed-rate financing may be best. Search for online evaluations and contrasts of lending institutions to learn Check Out Your URL about other consumers' experiences and see which lending institutions might be an excellent fit based on your credit reliability.

Personal Loans Canada Fundamentals Explained

This can normally be done over the phone, or in-person, or online. Depending upon the credit report model the lending institution uses, numerous hard inquiries that occur within a 14-day (sometimes as much as a 45-day) home window could just count as one tough query for credit report objectives (Personal Loans Canada). Furthermore, the scoring design might overlook questions from the previous 30 days:max_bytes(150000):strip_icc()/whatsapersonalloan-49a4338af74741e7b4dbb0884a191283.jpg)

Individual lendings aren't for every person. If you require funds currently, there are always various other choices that may fit your needs much better. Each of them bill rate of interest, yet they're worth considering. Below are a few options to individual lendings, all of which lug their very own risks and benefits relying on your situation.

Individual loans can be complicated, and locating one with a great APR that matches you and your spending plan takes time. Before taking out an individual car loan, make sure that you will certainly have the ability to make the month-to-month repayments on time. Individual finances are a fast method to borrow money from a bank and various other economic institutionsbut you have to pay the cash back (plus rate of interest) over time.

Some Known Factual Statements About Personal Loans Canada

There could be limitations based on your credit rating or background. Make sure the lending institution supplies loans for at the very least as much money as you require, and look to see if there's a minimum funding amount. However, know that you might not get accepted for as big of a funding as you want (Personal Loans Canada).Variable-rate financings tend to begin with a lower rate of interest, but the rate (and your repayments) can climb in the future. If you desire certainty, a fixed-rate loan may be best. Seek online testimonials and comparisons of lending institutions to learn about various other customers' experiences and see which lenders might be an check my blog excellent fit based on your creditworthiness.

This can normally be corrected the phone, or in-person, or online. Relying on the credit report model the lender makes use of, several hard inquiries that occur within a 14-day (occasionally approximately a 45-day) window might just count as one hard query for credit rating purposes. Additionally, the racking up version may overlook inquiries from the previous 30 days.

Some Of Personal Loans Canada

If you obtain authorized for a funding, checked out the fine print. Check the APR and any kind of various other fees and fines. You must have a full understanding of the go to my site terms prior to consenting to them. Once you accept a car loan deal, several loan providers can move the cash straight to your checking account.:max_bytes(150000):strip_icc()/Pay-Day-Loan-Personal-Loan-dfdeaa22f6ea4790b1c966fcd6c937cf.jpg)

Individual loans can be made complex, and locating one with an excellent APR that suits you and your budget plan takes time. Prior to taking out a personal loan, make sure that you will certainly have the ability to make the regular monthly repayments on time. Individual lendings are a quick method to borrow cash from a financial institution and various other economic institutionsbut you have to pay the cash back (plus passion) over time.

Report this wiki page